Your Schedule Changes. Your Mileage Tracker Keeps Up.

Home health schedules are chaotic. Cancellations, add-ons, reschedules—your day never goes as planned. This mileage tracker is built into your schedule, so it adapts automatically. No separate app. No manual logging. No lost money.

This month's savings

December 2024Tax time came and my accountant asked for mileage records. I had nothing. I guessed, and I know I left thousands on the table. I drive to five or six homes a day and I couldn't tell you how many miles that was last Tuesday.

RRachelEarly Intervention OT · Founding user

Everything You Need to Track Mileage

Adapts with you when plans change—because they always do

Embedded in Your Schedule

Not a separate app. Your mileage tracker lives inside your schedule.

Adapts to Changes

Cancellations and reschedules? Recalculated instantly.

Only Verified Visits

No-shows don't count. Only verified appointments are included.

Export PDF or CSV

One click. Ready for your agency or accountant.

IRS-Compliant

Date, location, distance. Everything the IRS requires for mileage substantiation.

Real Driving Routes

Actual miles driven, not guesses.

Simple, Automatic, Accurate

No complicated setup. No manual entry. Just mileage that tracks itself.

Schedule Your Appointments

Add appointments to your calendar with patient addresses. Mileage tracking is already built in—no manual entry needed.

Mark Appointments Complete

After each visit, verify the appointment. Mileage is automatically calculated between consecutive verified appointments.

Export When Needed

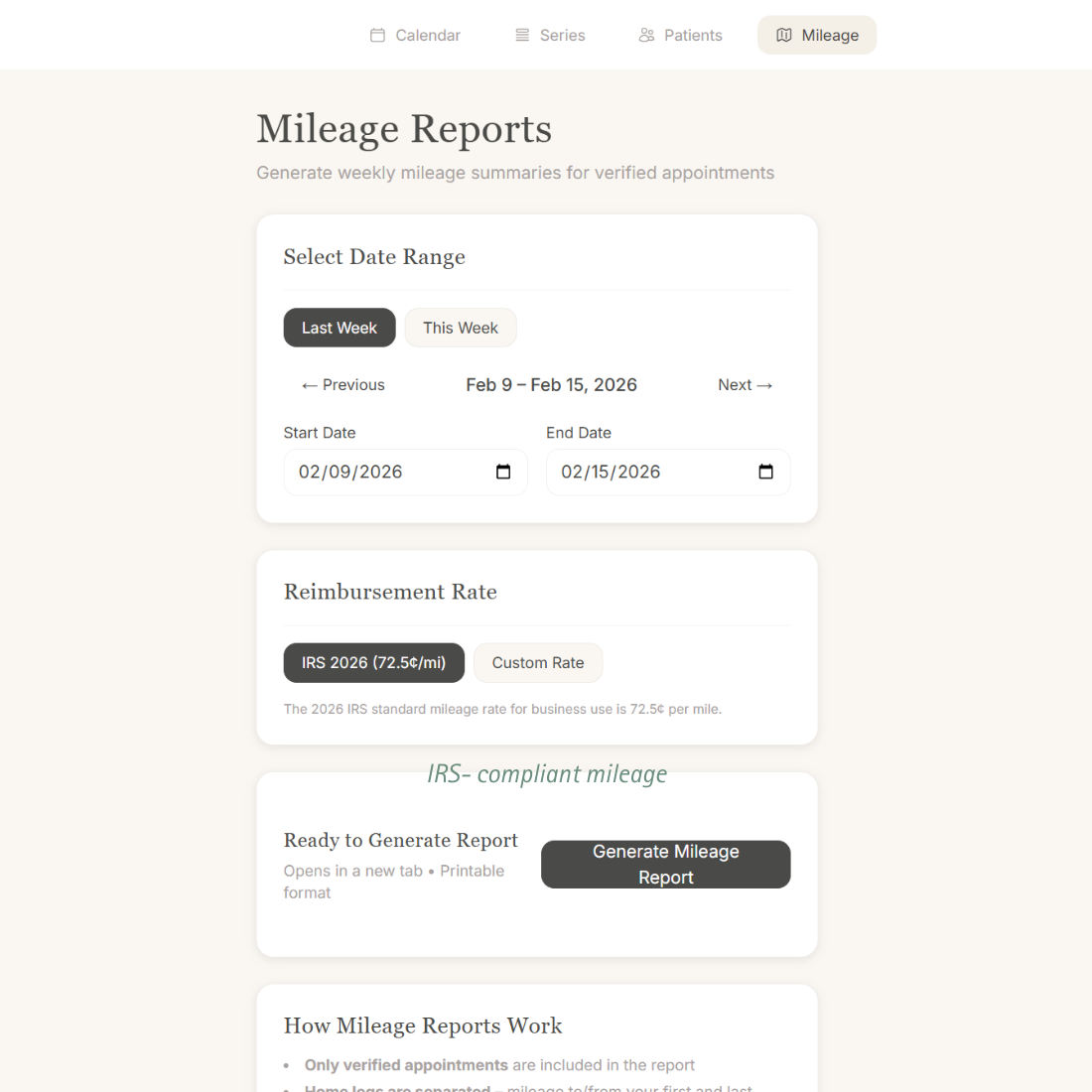

End of week, end of month, tax season—generate your mileage report in whatever format you need. Whenever you need it. One click.

Built Different for Home Health Mileage Tracking

Generic mileage apps vs. Schedule Companion

Generic Mileage Apps

Schedule Companion

Tracking Method

Manual start/stop for every trip

Automatic from your schedule

Integration

Separate app

Built into your calendar

Data Entry

Type addresses, notes for each trip

Uses appointment data you already entered

Schedule Changes

Manually delete and re-enter trips

Recalculates automatically

Trip Verification

Tracks all trips (personal + business)

Only verified appointments count

Frequently Asked Questions

Who is this mileage tracker for?

Schedule Companion is designed for home health practicioners—OTs, PTs, SLPs, nurses—and small agencies that need accurate, automatic mileage tracking tied to real visits. It's not a generic driving tracker or fleet tool—it's built specifically for home health workflows.

How does this work with my existing EMR or billing system?

It doesn't replace anything—it fits in. Export your mileage report as PDF, Excel, or plain text and put it wherever you need it. We're not trying to be your EMR, your billing software, or your accounting system. Just the mileage tracker that actually works for home health.

What happens when I cancel or reschedule an appointment?

The mileage recalculates automatically based on what actually happened. If you cancel an appointment, it's removed from the mileage calculation. If you reschedule, the new route is calculated. Your mileage report always reflects your real day, not your planned day.

Does it track my location in the background?

No. We respect your privacy. Mileage is calculated based on the addresses you enter for appointments, not live GPS tracking. We're not monitoring where you actually drive—we're calculating the driving distance between the appointments you verify.

Is this accurate enough for tax purposes?

Yes. The IRS requires a contemporaneous log showing date, business purpose, destination, and mileage. Because mileage is tied to your verified appointments (which already have dates, addresses, and patient names/pseudonyms), you have everything needed for substantiation. Always consult your tax professional for specific advice.

Do I have to use the IRS reimbursement rate?

No. The IRS standard mileage rate is the default, but you can enter your company's specific reimbursement rate to estimate what you'll actually receive. This is especially useful if your agency reimburses at a different rate than the IRS standard deduction.